In recent months, investors in multiple sectors have dealt with the twin scourges of rising inflation and fluctuating asset prices. Right now, it’s a situation that means there aren’t very many investment vehicles that can still deliver high returns without some major volatility to go along with it.

However, there is one investment type that continues to defy the overall market forces to provide a safe and stable growth option: fine art.

As a result, high-net-worth individuals all around the world are increasingly turning to art as an investment, with such investments increasing in volume each year over the past few years. The trouble is that investing in fine art traditionally wasn’t an option for anyone without large sums of capital to invest. That is, until now.

Today, anyone can invest in fine art through the Masterworks app, and they don’t have to be wealthy to do it. Here’s why fine art is a great investment and how Masterworks makes it accessible to the masses.

Why Invest in Art?

As an investment class, fine art offers unique price stability and a rate of return that you can’t find anywhere else. Plus, it shows very little correlation with other asset classes, making it a relatively safe harbor investment during recessions or other periods of economic instability.

Between 1995 and 2022 alone, fine art, as a category, outperformed real estate returns in the US by 8.1%. It also outperformed gold by 6.7% and corporate bonds by 7.7%.

Fine art even bested the total return of the S&P 500 — the de-facto benchmark for the US economy — by 3.6% during that span.

Traditional Barriers to Art Investment

In the past, any serious effort to invest in fine art required an investor with plenty of financial wherewithal, extending well beyond the price tags of the paintings themselves.

They needed enough money to hire someone with the right expertise to identify investment targets with a high probability of appreciation. They needed someone to attend auctions to make purchases on their behalf. And most of all, they needed the help of someone who could give them some clarity into the opaque world of art valuation so they could track their portfolio’s performance.

All of that set a high bar to participation in art investment that the average investor had no hope of meeting. And even if investors wished to pool their money to participate in the market, they still had to find a way to collectively procure and manage the assets once purchased, which is how art portfolio-based funds rose to prominence.

The Masterworks Solution

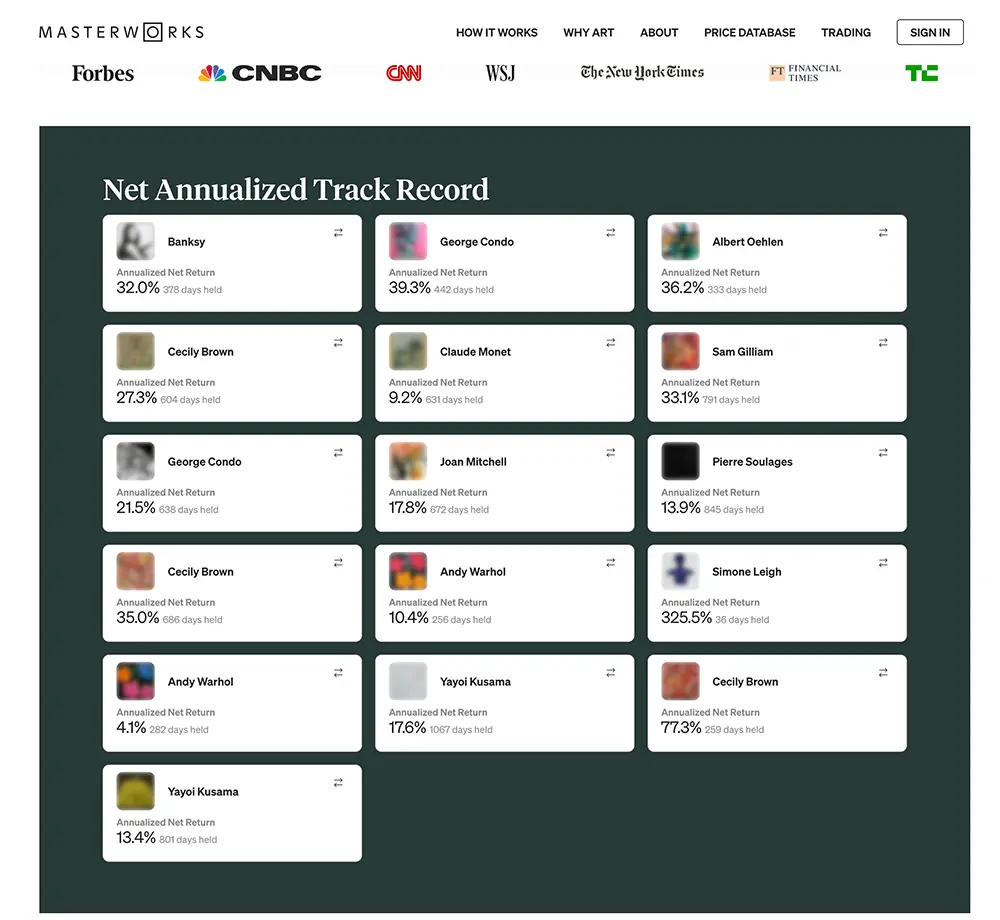

Masterworks helps individual investors overcome the barriers to entry into the fine art investment market by turning individual works of art into fractionalized investment opportunities. Here’s how it works. They use their in-house art and data expertise to identify artists who have produced consistently appreciating artwork and then select and purchase individual artwork from those artists.

Then, Masterworks offers shares in each artwork by filing an offering circular with the Securities and Exchange Commission. This results in purchase prices that are well within the financial means of average investors, who may purchase as many shares as they wish. Next, investors simply have to wait for Masterworks to sell the painting for a profit, which typically happens within three to ten years.

In the interim, investors can trade their shares on Masterworks’ on-platform trading market to provide a means of monetizing shares before the sale of the artwork occurs. Otherwise, they can rely on Masterworks’ team of art sales specialists to leverage their connections to large collectors to hopefully secure a profit on each piece.

To date, Masterworks has purchased 344 individual works of art and has over $882 million worth of assets under management. They also boast over 800,000 platform members, which is a testament to the vibrancy and utility of their platform. In other words, they’re a robust and mature investment market with a track record for stability and successful profit generation.

The Takeaway

The bottom line is that Masterworks is changing the fine art investment market by increasing accessibility and making investing as easy as it can be. As a result, individual investors can take advantage of an investment class that routinely outperforms other options, and isn’t as volatile as vehicles like stocks, bonds, and other securities.

While no investment opportunity is sure to yield profits, fine art’s performance to date is impressive. At a time when it’s harder than ever for a small-time investor to earn steady returns, Masterworks has changed the marketplace’s dynamics.